Megatrends

Written By: Milja Mieskolainen

Megatrends are macro-level phenomena, ie they affect the whole economy. They can also be thought of as driving change in the world and setting the direction for global economic and societal development. Thus, the effects start at the global level, and a single company, for example, does not play a very big role. Understanding individual megatrends is not enough. It is essential to understand the complex system they build, and how much interdependence affects the whole.

It's a good idea to start by looking at it from the top down, and the way to do this can be, for example, taking into account the content of your everyday life. An individual can choose a topic of their choice, such as a change in family structure. Today, there are fewer children in the family, so apartments are smaller and households are concentrated in cities. This very simple example combines the megatrends of population development and social change as well as urbanization: If we move to a detailed level, e.g. technology and climate change can be seen as well. Special attention must be paid to the whole, as things that seem simple are not always simple.

Ecological reconstruction

How to meet the challenge of climate change? It is not entirely clear how exactly the climate will change. However, we do know that it will change dramatically. Increasing life expectancy and accelerating prosperity are increasing the demand for resources such as water, energy, and food. The average surface temperature of the Earth has risen since the 19th century and shows no signs of slowing down yet. The use of fossil fuels is the single biggest cause of global warming, and growth in atmospheric carbon dioxide has not slowed. Climate change is pushing for a change in our culture and the way we live.

Climate change is often thought to be at the heart of megatrends. There is an urgent need to correct the natural sustainability gap, and there is no time for the tensions that have built up around it. The change in perspective is an essential part of the development process, hopefully at the end of which is a future where climate goals are met. Confrontations between underestimation and climate activism, as well as awareness and action, are hampering a positive direction.

From an investment perspective, climate change and ecological reconstruction offer opportunities. As a result of the innovation, we will see e.g. solutions to food shortages and renewable energies to replace fossil fuels. By investing in these solutions, such as wind power or software that analyzes weather forecasts, an individual can also be a part of global development.

Population aging and social change

The aging of the population, especially in Finland, has been on the surface for several years now, and it has shaped the debate in various fields. In China, for example, there are currently about 29 million people over the age of 80, but by 2050 there will be 120 million of them. People will also live longer, and at the same time, the number of children born will decrease. The decline in the number of children is particularly acute in the affluent and well-educated sections of society, while at the same time the population in developing countries will increase. The 2017 UN study predicted that the world’s population will grow by a billion by 2030.

In discussions, other topics related to demographic change, are often overlooked. These include, for example, the growing diversity of the population and the empowerment of girls and women. In the case of Finland in particular, there is a certain kind of bubble emerging, as women and girls are, at least superficially, on an equal footing with men. The situation is not the same all over the world, and since we are talking about megatrends, it is important to keep in mind the global perspective, as the effects can be felt also in Finland.

As the population ages, pressures on health care and care for the elderly increase. Companies that develop solutions to global and age-related diseases such as Alzheimer’s and cancer can thrive in an aging market. Demographic change is driving change in consumption behavior from two different directions. Young people do not consume in the same way as their parents or grandparents, but eating habits and leisure consumption are formed as a combination of different influences. On the other hand, the growing structural share of older people is driving companies to meet their needs with ever-increasing capacity.

Economy & networking

The idea of a multipolar world is not new, but it may soon become obsolete. A multi-node world means a situation in the future where networking and relationships with others displace individual focal points. States alone do not dominate significant roles, as companies, international institutions, cities and lobbyists are closely involved in the scene with their influence. It may be that the position of the United States as the global leader will be diminished. U.S. companies and organizations are still closely involved in the development.

Will China take the place of the United States? Perhaps some other growing economy will enter the field as a new influencer? China’s rapid population growth and middle class have done a favor for companies operating in its market. For example, luxury goods, cars and smart devices have gained a significant place in the growing Chinese market. As China continues to grow, companies looking for low-cost labor will shift their gaze to India and other countries in Asia.

Networking brings challenges. Polarization, strong leaders, new movements and populism are raising issues around the world. People are increasingly looking for faster solutions to the world’s problems, from climate change to simple formula changes. Democracy is seen as slow, inefficient and incapable of meeting the challenges of our time. The amount of false information is growing at an alarming rate fueled by fake news spreading online, contributing to polarization and the emergence of radical movements. It is impossible to predict how future policy will be implemented. The Paris Agreement of 2019 was the beginning of a united response to climate change, but with the withdrawal of the United States, hope will shift to business.

From an investor’s perspective, this megatrend is particularly challenging. It is impossible to predict the direction of the future with complete certainty. The most valuable tool is risk-taking, ie the same rules apply to utilizing or preparing for megatrends as to other investment activities. For example, combating climate change requires innovation from many different industries, making it worthwhile for an investor to diversify across many industries. Learn, diversify and make an impact.

Technological developments

Digitalization, technology and artificial intelligence are seen both as a threat and an opportunity. Before you start forming your opinion and incite opinions, you should delve into the subject in more detail. Understanding the related terms, systems, and concepts goes a long way, and at the same time, your thoughts become clearer. Digitalization refers to the use of digital technology in services and human interaction. Technology is an umbrella term that is defined differently in different fields. In general, it refers to machines, equipment and production processes, as well as know-how and knowledge. There is also no unambiguous definition of the term artificial intelligence: Autonomy and adaptability are often used.

Programmed organisms will become more common in production as genetically modified and synthetic biology allow the creation of new types of organisms. Health technology is evolving and it will be available to everyone. Portable health monitoring devices in their various forms are already part of everyday life and their development continues. Renewable energy is becoming cheaper and energy production is decentralized when citizens produce their own energy, for example through solar panels. As a whole, artificial intelligence and digitalization will permeate society, and understanding them at both the state and individual levels will help with behavior and decision-making. Will everyone be in touch? Is there a definitive shift from “individuality” to everything connected? Does technology affect everything?

You should be careful with technology. Investors often don’t have all the information they need from the start, so caution is necessary. Innovativeness and long-term growth can be factors that are useful to follow. Diversification to different sectors should not be forgotten and you should actively monitor the contents of your portfolio, as investing in a megatrend does not necessarily cover different sectors per se. The change in companies and industries is rapid, and investing in a megatrend does not necessarily equate to adequate returns.

Urbanization

With urbanization, megacities and smaller metropolises will shape the near future. Housing costs are rising in the most sought-after cities, and the need for larger buildings is growing. The new buildings incorporate technology that makes them more efficient. The volume of food transport is increasing as it has to be moved from its place of production to the place of consumption. Another option is urban farming either in or near cities.

The advantages of urbanization are associated with good infrastructure, which enables, for example, energy-efficient solutions. Everyday life becomes easier, as all services are close by and thus the need for long trips is reduced. Interesting jobs attract a skilled workforce to cities, creating an ideal platform for new innovations and businesses. There are certainly as many disadvantages as there are good ones, and urbanization is not a black-and-white megatrend.

New cities need the technology required for infrastructure and other construction. Cities in developing countries, in particular, will need more infrastructure in the future. As cities develop, so do their needs: The growing middle class increases the need for cars, better housing and leisure activities, for example. In big cities, large-scale transport connections and electrification offer big opportunities. The investor should consider this urban development, and look for companies that will benefit from it. It is also worth going through the concentration of ideas offered by urbanization carefully because when know-how is concentrated, new innovations tend to be clustered around certain places.

Investing in megatrends

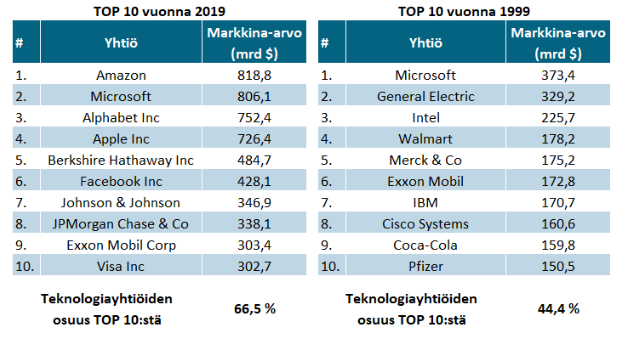

As mentioned earlier, investing in megatrends is subject to the same rules as other investment activities. Because megatrends are major structural changes, they affect societal structures as well as consumer behavior and corporate power relations. The world has taken great strides in the past as well, and the investor needs to notice the companies that have benefited from megatrends.

Many companies report benefiting from megatrends in their annual reports. When a megatrend is identified in the market, it also brings challenges. The future is made to look good and bright, but in reality, things are never black and white. If one benefits from one megatrend, such as urbanization, another can be detrimental to business. It is generally thought that climate change is a “safe” megatrend as regulation is expected to tighten. When picking shares, it is worth taking into account the improvement in the competitive position brought about by the megatrend and whether the position will improve at all due to the megatrend.

If stock picking and analyzing individual companies sounds cumbersome, different ETFs can provide an easier way to invest. They have often chosen a specific strategy for stock selection (Internet and technology, clean water, cybersecurity, artificial intelligence…), but as the valuation ratios of megatrend stocks increase, so do the valuation ratios of the ETFs that own them. A single investment can provide a good diversification advantage, and the costs of ETFs are often lower than those of traditional funds.

COVID19 & megatrends

Pandemics are not megatrends and are not mentioned in major megatrend surveys. The coronavirus is regarded as a “wild card” that challenges the current trend. At the same time, megatrends can help understand the effects of the coronavirus. The coronavirus, like wild cards in general, was not entirely unexpected. “Disease X” has been included in the WHO listings. "The question was not whether there will be a new viral epidemic, but when it will come," said Professor Olli Vapalahti in an interview with Helsingin Sanomat.

As a key theme, the effects of the corona are dominated by interdependence. We do not notice in everyday life how interconnected the economy, politics, well-being, technology and culture are. Major changes include tensions. An exceptional situation can open new doors or derail development costs. Does it change our thinking about the climate crisis, which is ultimately about human lives as well? The coronavirus pandemic also reveals the weaknesses of the current economic system. An intensified market economy has been looking for its direction for a long time, with wealth concentrated and environmental problems rocking its course.

The World Health Organization (WHO) has highlighted the information epidemic. There is a large amount of misinformation about the coronavirus, which incites confrontation and blame. For example, the news agency AFP publishes daily fact-finding stories (366 of which have appeared on 23 April 2020), as do the WHO and IFCN. You should also follow investment news with caution. The market situation is currently volatile and predictability is weak. If desired, a megatrend framework can be used in the analyzes, which can help to find companies that benefit from and survive the emergency.

List information on the topic:

Articles:

BlackRock - Megatrends: The forces shaping our future

MIT Sloan Management Review- column: The World in 2030: Nine Megatrends to Watch

Medium - Coronavirus: 9 Mega Trends Shaping The Post Corona Economy

Podcasts: Apple Podcasts and Spotify

ETF Prime - Back to the Future: iShares Megatrends

The Bid - Megatrends: 5 ways to think long term in the downturn & 14 questions answered about the coronavirus

Columbia Energy Exhange - Megatrends: What They Mean for Energy Markets